Mastering the Exness Scalping Strategy

In the world of Forex trading, efficiency and time management play crucial roles in achieving profitability. The Exness scalping strategy https://sistema76.ru/cuenta-islamica-exness-4/ stands out as one of the most popular methods employed by traders looking to capitalize on small price movements. This article delves into effective scalping techniques, risk management, and the essential tools required to succeed using this strategy.

What is Scalping?

Scalping is a trading strategy focused on making numerous trades throughout the day, each aiming to profit from small price changes. The primary objective is to accumulate small gains that add up to a significant profit by the end of the day. Scalpers typically hold positions for very short periods, from a few seconds to several minutes. The strategy requires a strong understanding of market dynamics and swift execution of trades.

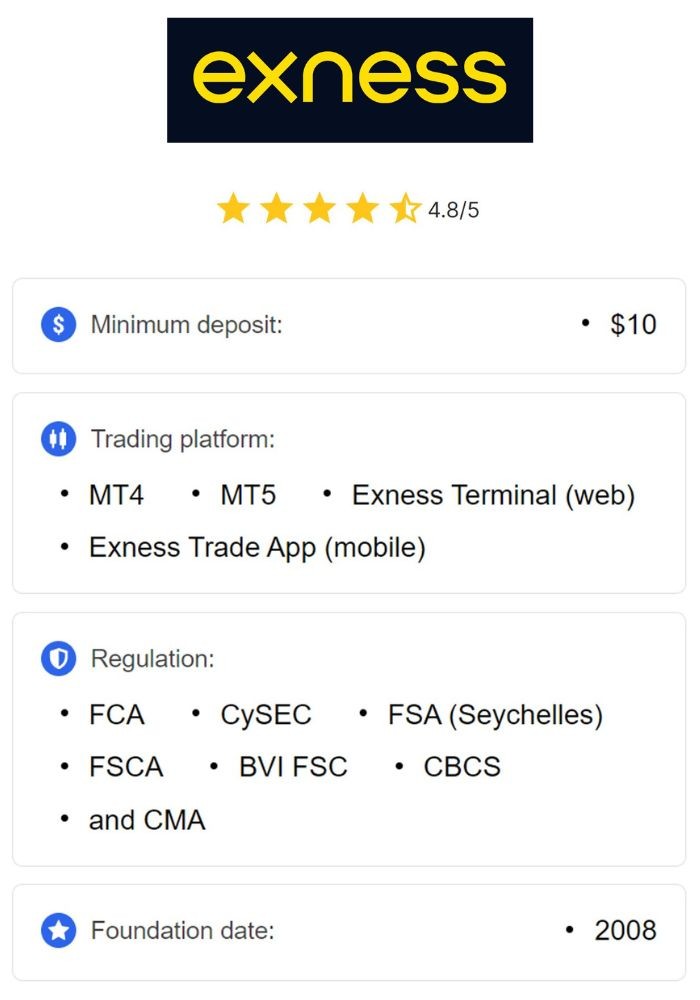

Why Choose Exness for Scalping?

Exness is renowned for its suitable conditions for scalping, making it an attractive choice for traders. Key benefits include:

- Low Spreads: Exness offers competitive spreads that are advantageous for scalpers looking to maximize their profit margins.

- Fast Order Execution: Speed is of the essence in scalping. Exness provides rapid order execution, which is crucial for capturing small price movements.

- Access to a Wide Range of Instruments: Traders can scalp various currency pairs and instruments without restriction.

Key Strategies for Effective Scalping with Exness

Implementing a successful scalping strategy involves several critical components:

1. Choose the Right Trading Platform

Your trading platform can significantly impact your ability to execute scalping trades. A platform like Exness, with an intuitive interface and quick execution times, can enhance your trading experience.

2. Use Technical Analysis

Technical analysis forms the backbone of scalping strategies. Traders should focus on:

- Price Action: Analyze historical price patterns to anticipate future movements.

- Indicators: Use tools like Moving Averages, Bollinger Bands, and RSI (Relative Strength Index) to determine entry and exit points.

3. Establish a Trading Plan

A well-defined trading plan includes:

- Entry and Exit Points: Determine when to enter a trade and when to exit to secure profits or minimize losses.

- Risk Management: Define how much of your capital you are willing to risk on each trade and adhere to this limit.

4. Stay Updated with Market News

Market news and events can impact currency prices dramatically. Being aware of upcoming economic releases or geopolitical events helps scalpers avoid unexpected volatility that could lead to losses.

Risk Management in Scalping

Risk management is crucial for any trading strategy, especially scalping. Here are essential tips:

- Use Stop-Loss Orders: Always set a stop-loss order to prevent excessive losses from unexpected market movements.

- Limit Your Exposure: Avoid over-leveraging your trades. A common mistake is to risk too much on a single position.

- Evaluate Your Performance: Regularly analyze your trades to identify what works and what doesn’t.

The Psychology of Scalping

Mental discipline is essential for successful scalping. Traders must maintain a calm demeanor and avoid emotional decision-making. Recognizing when to trade and when to stand back is paramount. Here are strategies to enhance your trading psychology:

- Stay Focused: Concentrate on your strategy and avoid distractions during trading sessions.

- Be Prepared for Losses: Understand that losses are part of trading and develop a mindset to accept them without emotional turmoil.

- Practice Patience: Wait for the right trading opportunities and don’t rush into trades simply out of boredom.

Conclusion

The Exness scalping strategy presents an excellent opportunity for traders looking to take advantage of small price moves. By utilizing technical analysis, establishing a solid trading plan, managing risks effectively, and maintaining a disciplined mindset, traders can enhance their performance and realize substantial profits. As with any trading strategy, continuous learning and adaptation to changing market conditions are essential. Start small, practice diligently, and progressively enhance your scalping skills to achieve success in Forex trading.